Week In Review: The Roll-Out. 1 January 2020

Week In Review: The Roll-Out

US equity indexes were higher on the week: DJIA +1.3%, S&P 500 +1.4%, NASDAQ +0.7%. It was a holiday shortened trading week. The market focused on the size of the US stimulus bill, the rising coronavirus case count as well as the new strain of Covid-19, and the vaccine roll-out.

On December 14th, the UK announced that it had found a new variant of coronavirus. As of December 31st, the new strain has been found in three US states: Colorado, California, and Florida. As if the vaccine roll-out was not crucial enough, it has taken on new urgency. Unfortunately, the US fell well short of the government’s target to vaccinate 20 million people by end-December. According to the CDC, as of December 30 at 9:00am EST – the latest data available- 2.8 million people in the US initiated vaccination and 12.4 million doses had been distributed.

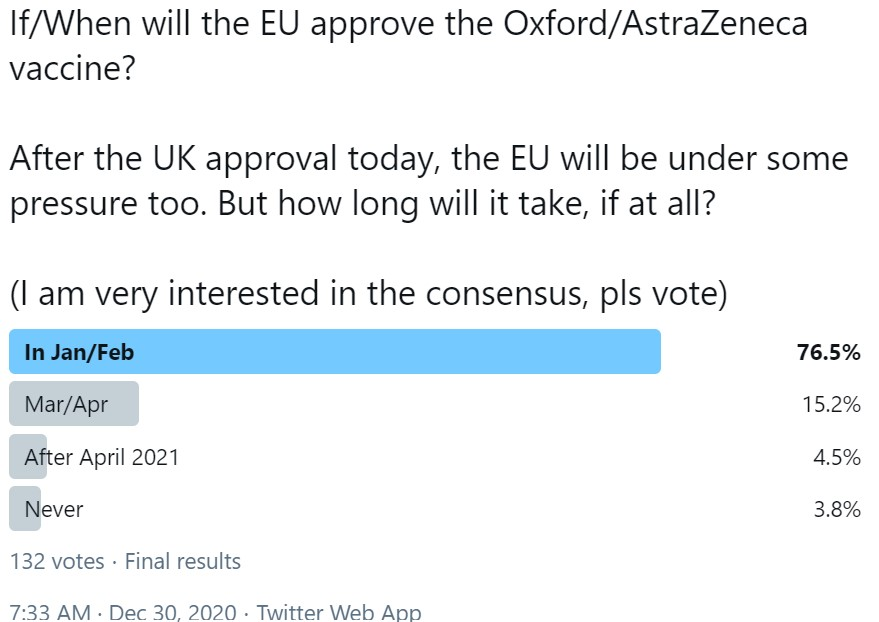

On December 30th, the University of Oxford/AstraZeneca Covid-19 vaccine was granted emergency use authorization in the UK. Founder Jens Nordvig says, “This should allow a much accelerated vaccine roll-out in the UK given easier storage, and the focus on the first dose. Globally, the focus will now be on additional approvals, with the EU under pressure to move.” Jens conducted a Twitter poll (below) asking if/when will the EU approve the Oxford/Astrazeneca vaccine. Results showed that even though Oxford/AstraZeneca has not formally applied for approval in the EU (via EMA), there is a strong consensus that approval will be given within 2-months (76.5%). Jens says, “Hopefully, there will be no disappointments on this front.”

The UK has been in focus for its rising coronavirus case count, discovering a new strain of Covid, stricter lockdown measures, and of course Brexit. Read more on the recent UK lockdown measures and see its new peak in Covid cases here. On a brighter note, the UK’s Margaret Keenan, the first person in the world to be given the first shot of the Pfizer Covid-19 vaccine, was given her second dose.

Turning to Brexit, with the Brexit Deal achieved and published (here), there are 1246 pages of detail, summaries and side agreements to go through. Head of Political Risk Analysis, Wouter Jongbloed, and Senior Advisor Chris Marsh, note that “While all detail matters tremendously for the fortunes of certain sectors and industries, the high level operation of the deal is what ultimately matters for the market.”

Wouter and Chris say “The revealed Brexit Deal appears as ‘skinny’ as we assumed, concentrating on securing a framework for continued zero-tariffs, zero-quota market access for goods, while leaving trade in financial services, many data/digital questions, and long-term standard recognition outside the four corners of the agreement.”

Ahead Next Week: Select economic releases: Sunday, Jan 3: China Caixin Manufacturing PMI (Dec). Monday, Jan 4: German/Eurozone/UK/Canada Manufacturing PMIs (Dec). Tuesday, Jan 5: Germany Retail Sales (Nov), Germany Unemployment Change (Dec), US ISM Manufacturing PMI (Dec), Japan Services PMI (Dec), China Caixin Services PMI (Dec). Wednesday, Jan 6: Germany/Eurozone/UK Composite PMIs, Germany CPI (Dec), UK International Reserves (Dec), US ADP Employment, FOMC Meeting Minutes, Australia Trade Balance (Nov), Japan Foreign bond buying/foreign investment in Japanese stocks. Thursday, Jan 7: China FX reserves, Eurozone CPI (Dec),Eurozone Retail Sales (Nov), US Initial Jobless Claims, US Trade Balance (Nov), US ISM Non-Mfg (Dec), Canada Ivey PMI (Dec), Japan foreign reserves (Dec). Friday, Jan 8: Germany Current Account Balance (Nov), US Payrolls (Dec), Canada Employment (Dec), Fed Vice-Chair Clarida speaks on US Economy and Monetary Policy.

USD Comment

USD was weaker this week. The DXY Index fell once again below 90.00 support, ending the week at 89.93. GBP ranged 1.3433 to 1.3684 – initially weaker on the Brexit deal announcement as the hope of a deal had been priced in, but then gained steam later in the week. EURUSD reached a high of 1.2308 but then backed off in holiday thin markets ending the week at 1.2214. Higher beta FX strengthened vs. USD as US equity indexes rallied for the week. AUDUSD broke topside 0.7700.

Since it is the start of January, we look at USD seasonality for the month from our proprietary FX factor model (below). In G10, USD is weaker vs. CHF, JPY, and NOK. Also, AUD, but less so. USD gains most for the month vs EUR and SEK. Re: other currencies, USD gains the most vs RUB, TRY, CZK, and PLN. It weakens vs. BRL, CLP, COP, and ZAR.

Exante Data Media

Founder Jens Nordvig was on Bloomberg talking why he expects a big USD move weaker in 2021, the fact that real money does not have on a large USD short position yet, and whether we are entering a new political regime in the US where aggressive fiscal stimulus could change the inflation outlook on a multiyear horizon.

Head of Asia Pacific, Grant Wilson has a new opinion column out for The Australian Financial Review: Digital Currencies Quietly Plot Their Place in History. “The most systemic development, by far, is China’s launch of a digital currency. Whether referred to as the e-yuan, or DCEP (digital currency electronic payment), this project has stolen a multi-year march on the G-10, and could well reshape the global payments system, and global central banking as we know it, over the next decade.”

Senior Advisor Chris Marsh was quoted this Wall Street Journal article: How the 2020 QE Boom Might Trip Up Central Bankers. WSJ also linked to our Substack blog.

Amelia Bourdeau spoke with TD Ameritrade on Covid on December 22nd. She talks the new strain of Covid, the third wave maturing in the US, and shows some Exante Data Covid charts which you can see updated daily on our Twitter account. Since the interview, however, the new strain of Covid has been found in three US states. Play from 6:02 min in to hear about the race between the new strain and the vaccine roll-out.

If you have any downtime and are looking for something to read, consider our Substack blog. Chris Marsh has written a three part series on could there be a Eurozone liquidity crisis, Jens asks “what is good money?”, Alex Etra writes about surging EM capital flows…and more!

If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, and/or Exante Data API services — please reach out to us here.

2020 was a remarkable year. Thank you for reading and engaging with Exante Data – we appreciate it. Happy New Year – may 2021 bring you success and joy!