Week In Review: The Game Stopped. 5 Feb 2021

Week In Review: The Game Stopped

US equity indexes rebounded from the previous week’s losses: DJIA 3.9%, S&P 500 4.6%, NASDAQ 6.0%. Last week’s unusual activity involving GameStop and equity market pullback subsided and the market focused on the optimistic topics of US fiscal stimulus hopes and the continued vaccine roll-out.

Gold was lower on the week, ending at $1815.20. We point out that the flow picture for gold remains parlous. ETF flows have weakened through November and December, before finding some year-end support. But, flows over the past week have been negative. Our tracking of central bank flows to Gold also highlights that 2020 was the weakest year since 2016, in cumulative terms – that chart is below.

Senior Strategist Chris Marsh catches us up on the UK – here are his notes: Last week the Bank of England left policy unchanged as expected but signalled changes to the policy toolkit are in preparation. While underlining the fact that they were not signalling a future policy move, the MPC tasked the PRA to engage with banks to “commence preparations in order to be ready to implement a negative Bank Rate at any point after six months.” In addition, Bank staff were requested “to commence work to reconsider the previous guidance” on future unwinding of asset purchases. Previous guidance, from June 2018, insisted that asset purchases would not occur until Bank Rate reached about 1½ percent.

The MPC is clearly rethinking policy along a number of dimensions—with negative rates available to break through the zero-lower bound, but a more downward-flexible balance sheet. This innovation in thinking should not be a surprise. Previously, Governor Bailey had indicated in his virtual Jackson Hole speech that the “effects of QE are more powerful in crisis states of the world, we may need to ensure that we have enough headroom in the future to repeat it. The determinants of QE unwind may therefore be more subtle than previously thought, and the Covid crisis offers a new lens through which to assess its role.” Likewise, External MPC member Silvana Tenreyro, in advocating negative rates, reflected on QE more as a firefighting tool and less as contributing to stimulus. “I believe that quantitative easing is important in the event of market dysfunction, for example, but also that its power mainly lies in helping offset the disruption, rather than providing net additional stimulus to the economy.”

And so, the MPC is quietly undertaking their own toolkit revamp with implications for policy in the next decade. More immediately, Thursday’s policy meeting provided an optimistic assessment of the post-vaccine prospects for recovery, with the MPC suggesting the economy will be above potential in a year’s time—implying negative rates are unlikely to be used this cycle. GBP rallied about 0.5% in response to the policy statement and further still during the press conference when Governor Bailey underlined this optimism. -Chris Marsh

Ahead Next Week: Select economic releases. Chinese New Year begins: Sunday, Feb 7: Japan Current Account (Dec), China Trade Balance, Israel FX Reserves. Monday, Feb 8: NZ Holiday, Germany IP (Dec), Australia NAB Business Confidence (Jan). Tuesday, Feb 9: Germany Current Account Balance/Trade Balance (Dec), Australia Westpac Consumer Sentiment (Feb), China CPI (Jan). Wednesday, Feb 10: Germany CPI (Jan), Norway CPI (Jan), US CPI (Jan), BoE Gov Bailey: Mansion House, Participation ECB Pres Lagarde in newsmaker webinar by The Economist, Fed Chair Powell speaks on “State of US Labor Market.” Thursday, Feb 11: Japan Holiday, Chinese New Year festival starts, US Initial Jobless Claims, Japan Foreign bond buying/foreign investment in Japan stocks, Israel Trade Balance(Jan). Friday, Feb 12: China Holiday, UK GDP (Q4)/Business Investment (Q4)/IP (Dec)/Trade Balance (Dec), Norway GDP (Q4), Switzerland CPI (Jan), EZ IP (Dec), US U of Michigan (Fed).

USD Comment

The USD was mixed to stronger last week. This was interesting as risk seeking sentiment in US equities was strong. USD also outperformed slightly relative to moves in rates. The DXY Index Index ranged 90.51-91.59, ending the week at 91.00. EUR is the DXY’s largest component. EURUSD ranged 1.2134-1.1953, ending the week at 1.2048. The move back to 1.2000 lacks an obvious macro catalyst. Our proprietary FX seasonality model shows that EUR is weak in Q1 vs USD (ie seasonal factors work against EUR) – see the table here. GBPUSD started the week at 1.3746, declined to a low of 1.3566 ahead of the BoE on Thursday. GBP rallied on the BoE’s policy statement and further during the press conference given Governor Bailey’s optimism, ending the week back above 1.3700. (see comments from Chris above). Higher beta FX was generally supported by risk seeking sentiment.

Coronavirus: US Update

On Thursday, Johnson & Johnson filed for emergency use authorization in the US of “its investigational single-shot Janssen Covid-19 vaccine candidate.” According to the press release, “Johnson & Johnson intends to distribute vaccine to the U.S. government immediately following authorization, and expects to supply 100 million doses to the U.S. in the first half of 2021.”

In addition, the press release went on to say that the Company “will submit a Conditional Marketing Authorisation Application (cMAA) with the European Medicines Agency in the coming weeks.”

On January 29th, Johnson & Johnson announced its phase 3 trial results – its Covid-19 vaccine candidate was “72% Effective in the US and 66% Effective Overall at Preventing Moderate to Severe COVID-19, 28 Days after Vaccination…and 85% Effective Overall in Preventing Severe Disease and Demonstrated Complete Protection Against COVID-19 related Hospitalization and Death as of Day 28.” For a comparison of the three Covid-19 vaccines: Pfizer, Moderna, and J&J – see this StatNews article.

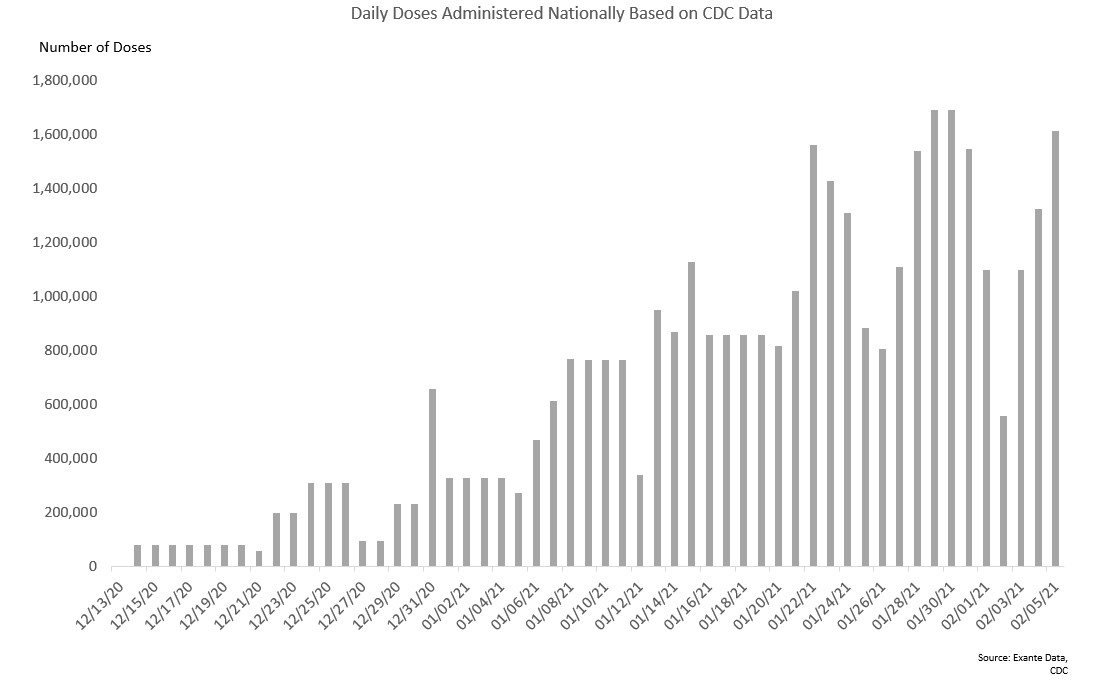

The chart below shows US daily doses of the vaccine delivered. There has been a pick-up since late January. The figures are choppy due to supply issues. The latest vaccination data from the CDC (Feb 5 6am EST) show that 58.4 million doses have been delivered and that 36.8 million doses have been administered.

US Covid-19 cases have been decelerating – see regional case chart here. Is the vaccine roll-out driving down US Covid numbers? Our table on hospitalization rates in the US suggests – no, not yet. The same proportion of cases turn up in hospital as 1-2 months ago. See US hospitalization rate table here – look at bottom line in table for “median”. However, Founder Jens Nordvig notes, “Just to clarify, we are vaccinating the vulnerable, once the vaccine has been administered to a big part of that group, we should see hospitalizations rates go down, even if case counts stay elevated (as in the UK, Israel).”

Exante Data Happenings & Media

We have a new Substack blog out by Senior Strategist Alex Etra:

China’s Balance of Payments (Part I): From the Trade War to a “Positive” COVID Shock. “What initially looked like a hit to global supply chains in China, turned into a global shock that ultimately supported China’s external balance significantly.”

Last week, we launched our Digital Currency Series for clients. Our first installment attempts to confront some of the issues around analyzing digital currency flows. Head of Asia Pacific Grant Wilson aims to provide weekly thematic pieces ahead.

- If you are an institution and would like more information on our Digital Currency Series, Macro Strategy, Global Flow Analytics, Exante Data API services, and/or our Covid research — please reach out to us here.

- Our Substack is public – Join us in discussing and debating large, macroeconomic topics – Subscribe here.