Week In Review: Position Squeeze. 18 June 2021

Week In Review: Position Squeeze

US equity indexes were down on the week: DJIA -3.4%, S&P 500 -1.9%, NASDAQ -0.3%. The focus of the week was the FOMC meeting, the outcome of which was more eventful than market participants had anticipated. Founder Jens Nordvig notes, “Many FOMC participants revised their 2023 dots higher, while the 2023 core inflation forecast was unchanged at 2.1% (in our judgement probably 6 participants moved from zero hikes to 2-3 hikes, which is a meaningful shift by more than a few participants). As such, it feels like the tolerance for an overshoot much beyond 2% is actually limited among many. Powell also noted, several times, that inflation expectations have risen, and that they are willing to raise rates should they break out of the range to the top-side. Finally, the discussion on tapering has started.”

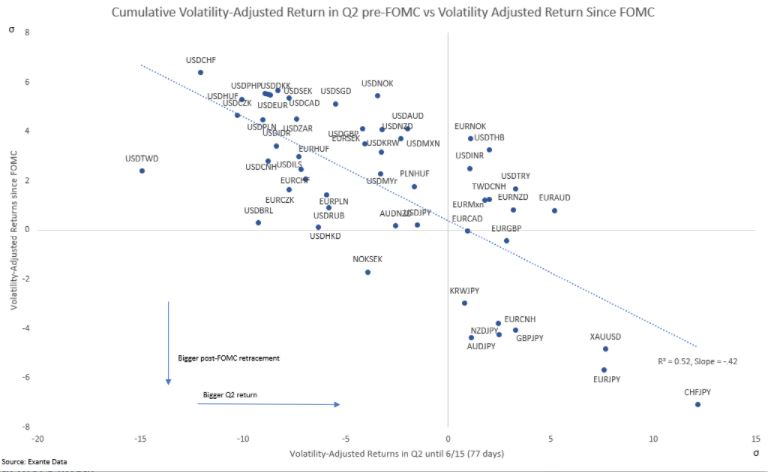

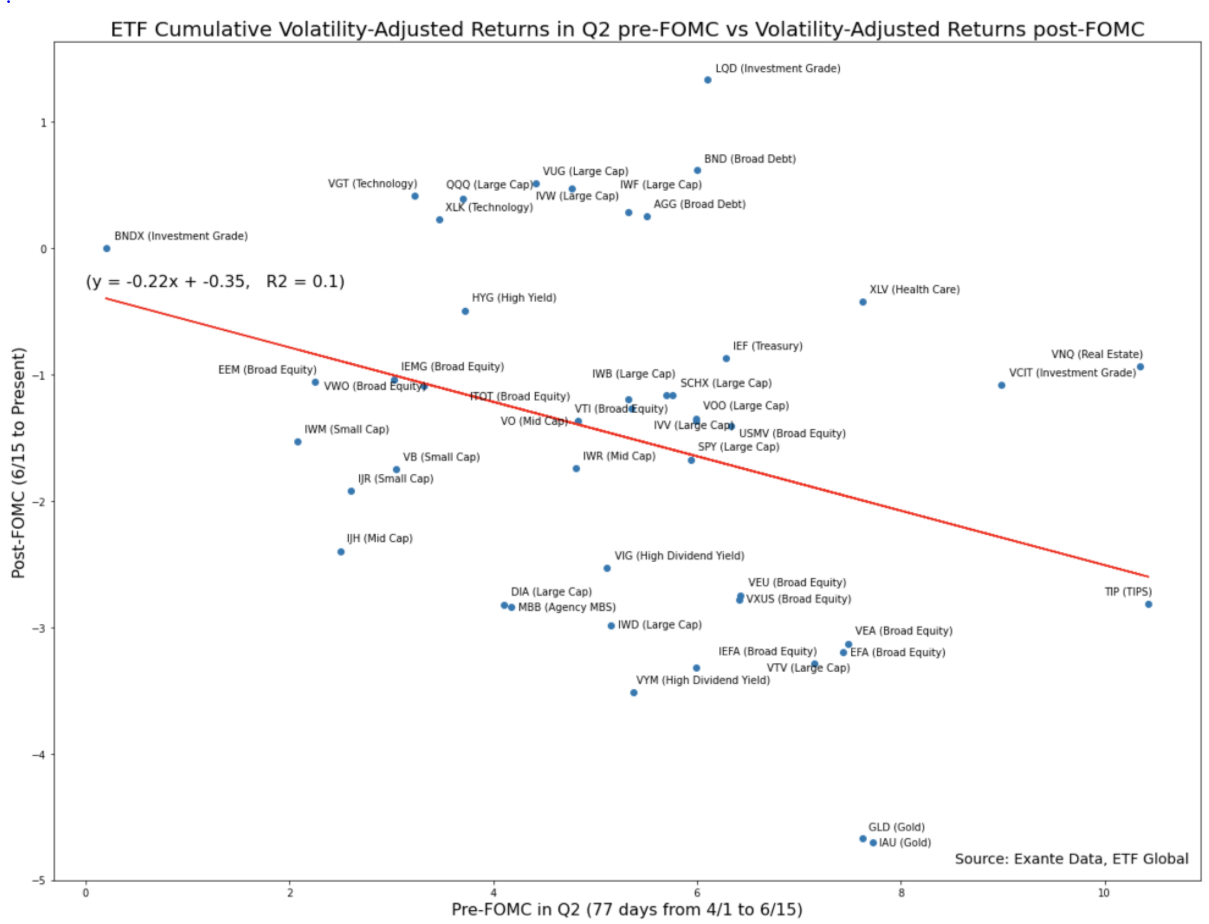

Position Squeeze: The Exante Data Team notes that a lot of the market movement post-FOMC has simply been about reversing the trends heading into the FOMC (the earlier trends in Q2). In other words, popular positions have been getting squeezed. Indeed, the chart below demonstrates that the most successful FX positions of Q2 saw the biggest retracements after the surprise. We can explain around 52% of the variation in the post-FOMC reactions with the pre-FOMC performance, suggesting that positioning is playing a large role.

Chart: FX Cumulative volatility-adjusted return in Q2 pre-FOMC vs. volatility adjusted return since FOMC.

USD Comment

USD was stronger on the week – the hawkish FOMC surprise drove the largest USD outperformance since September 2020. Our rates model (chart below) shows that USD returns beyond what would be expected given the rates moves reached 2.4bps.

DXY Index ranged 90.35-92.38, with a topside break through 91.00 coming post the FOMC announcement on Wednesday, and the high of 92.38 on Friday. The next high/resistance level is 93.26 from March. EURUSD, the DXY’s largest component, reached a low of 1.1854 on Friday. In G10 FX, higher beta NOK, SEK, and AUD declined the most on the week vs. USD and JPY the least. MXN was also adversely impacted. See FX heatmap here.

Covid-19 Update: Delta Variant

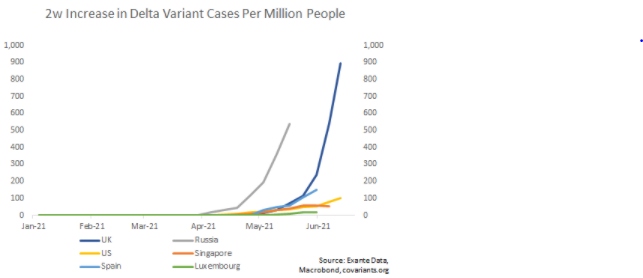

The Delta/Indian COVID variant is receiving increasing attention given its spread in various large economies, with the UK trends particularly stark. This week, UK PM Johnson announced the delay of “Freedom Day,” which was supposed to be June 21st.

Chart: We show the two-week changes in new Delta variant cases per million people (for countries have sequenced a meaningful amount of positive tests). What is interesting is that Delta case trajectories in Russia, the UK and Spain currently look different from in the US, Singapore and Luxembourg. It is possible, however, that the spread of the Delta variant will increase in the weeks ahead in those countries.

Exante Data Happenings & Media

Senior Advisor Chris Marsh published a timely Substack: The remarkable expansion of global central bank balance sheets during the pandemic. “After exceptional policy support during the pandemic, there are early signs that DM central bank balance sheet expansion is slowing; but what happens next?”

Francesco Papadia, Senior Fellow at Bruegel, wrote our first guest Substack: The evolving nature of central banking: Where next for Europe? “German and Italian history reveals evolving institutional structures and central banking models; ongoing changes at the ECB are only the latest manifestation of this historical process.”

Tourism Recovery: We launched our “Tourism” page on our data and analytics platform. Given the unpredictability of COVID-19 and travel restrictions, as well as the lagged nature of official tourism data, we also use alternative data from Google and on hotel bookings to closely track the return of global travel. To give clients real-time access to this data, we are launching our “Tourism” page. It provides an overview of the state of the industry in key tourist destinations (Mexico, Thailand, Turkey, New Zealand, Malaysia and South Africa).

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, Digital Currency Series, and/or our Covid-19 vaccine rollout tracking and Tourism Recovery tracking — please reach out to us here.