Week In Review: Party Up? 9 April 2021

Week In Review: Party Up?

US equity indexes were higher the week: DJIA +2.0%, S&P 500 +2.7%, NASDAQ +2.6% as the US re-opening/economic recovery theme is front and center.

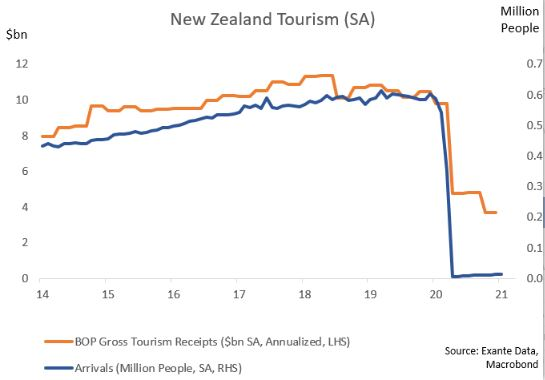

As vaccinations and re-openings also are progressing in many developed markets, market attention is turning to global tourism, the resumption of which is set to follow. We turn our attention to one case – New Zealand, which has seen tourist arrivals plummet. The BOP has been less affected than arrivals would imply, perhaps due to a large number of long-term foreign residents being captured as “tourists”. See chart below. The data show few signs of improvement so far, but NZ PM Jacinda Arden announced this week that that a travel bubble would commence as between Australia and New Zealand on April 19. There will be no mandatory quarantine requirement, nor is proof of vaccination required.

This is good news for New Zealand. According to Tourism Industry Aotearoa (“TIA”), prior to COVID-19 tourism generated ~20% of New Zealand’s export revenue, a direct contribution of 5.5% of GDP, and a further indirect contribution of 3.8% of GDP. TIA claims that tourism is directly or indirectly responsible for 13.6% of people employed in New Zealand. In addition, around 40% of New Zealand’s tourist arrivals prior to the pandemic were from Australia.” Head of Asia Pacific, Grant Wilson, notes: “We think macro markets are underreacting to the importance of the travel bubble, both in terms of the upside risks for New Zealand’s economy into Q2, and as a political signal in favor of the economy over COVID-19, from both Canberra and Wellington.”

Moving on to central banks this past week, here is Senior Advisor Chris Marsh’s take on the March ECB Minutes: “The minutes for the March meeting point to the growing influence of the Governing Council over policy. In particular, the Governing Council: (i) will review PEPP “purchase pace on a quarterly basis … based on joint assessments of financing conditions and the inflation outlook;” (ii) wished to push back against the “misperception” that they are engaged in yield curve control; and (ii) is turning more optimistic, noting ‘the balance of risk was now shifting and becoming more balanced, or possibly even starting to shift to the upside, having been on the downside’ in December. This creates the risk that some on the Governing Council will seek to taper PEPP purchases as early as the June meeting, creating event risk for markets. And the Executive Board will have to work to ensure that policy is not hijacked by hawks.”

USD Comment

The USD was weaker on the week. It was a strong week for US equities, but even by this metric, the dollar underperformed by more than expected. In fact, this is one of the largest gaps between USD performance and its long-term relationship to risk (see chart below – yellow triangle vs. dashed gray). US rates generally fell relative to most other global rates, but the magnitude of the change did not seem to explain the variation in the dollar’s performance, according to our model.

The DXY Index ranged 93.10 – 92.06, ending the week at 92.18. The low in the DXY came on Thursday, when EURUSD, its largest component, had a weekly high of 1.1925. EURUSD ranged 1.1739-1.1925. GBPUSD ranged 1.3917-1.3675, with the low on Friday. GBP support from vaccine rollout outperformance is waning. GBP lost ground vs. EUR – EURGBP ranged 0.8471-0.8692, with the EURGBP high on Friday. AUDUSD remained in a tight 0.7674-0.7591 range.

US: The Week In Review was on hiatus last Saturday. When we last wrote on 26 March, we were concerned about the growth of Covid cases in Michigan. Recent news for Michigan is “less bad” on the Covid front. At the end of March, week-on-week growth in new cases was >50%. It is now down to 23% week-on-week. See US state heatmap of weekly growth in covid cases here. On Friday, Michigan’s Governor Whitmer asked for a voluntary suspension of youth sports, in person high school learning, and indoor dining for the next two weeks.

Party Up?: Importantly, however, the broad picture in the US is that vaccinations seem to be keeping the final wave at bay in most cases, including in the biggest US states: CA, TX, FL. Hence, the central case is that the reopening, which is well underway and gaining traction, can be successful in Q2. Look at travel, as a percentage of 2019, starting in mid-February passengers departing from US airports tentatively started to trend higher. TSA is currently screening 10.0mn passengers per week vs 16.3mn in 2019. See chart here – there is also a rise around last week’s holiday.

On vaccinations/herd immunity: There has been a recent wave of negative headlines regarding the AstraZeneca Covid-19 vaccine as, Reuters reports, the EU drug regulator said that “unusual blood clots” should be listed as “very rare” side effects of the vaccine and the UK regulator also said blood clots cases were “extremely rare.” As such, the Exante Data team updated its herd immunity timelines for selected G10 economies and also stress tested the herd immunity model removing the expected AstraZeneca supply. Results show that even if recent negative headlines around the Oxford/AstraZeneca vaccine further increase vaccine hesitancy, completely removing this product from the forthcoming supply surge will only push back our herd immunity timelines by 1-2 weeks in the EU and Canada and have no impact on the US. The biggest hit would be from the UK which would be set back 4-6 weeks. However, we do not think the concerns about safety/side effects or a loss of public confidence will derail the UK vaccination campaign in the same way that the bungled communication by continental health authorities may have done in the EU. According to our forecast model that includes the AstraZeneca supply, the UK and France are expected to reach herd immunity in early July, Germany in mid-July, the US in mid-May, and Canada in mid – June.

The charts below show – the pace of vaccine administration has increased once again in the EU after Easter holidays. The pace in the US – while much higher than in the EU – has yet to return to its pre-Easter level.

Exante Data Happenings & Media

Senior Advisor, Chris Marsh, wrote a three part series on US financing for our Substack blog: To catch a falling knife: US Treasuries and the Fed. “The continued US deficit in 2021 puts Treasuries in focus, with 10y yield already having moved about 80bps higher to 170bps, & a number of weak primary auctions in Q1. What’s going on? In a series of Substack blogs, we attempt to frame the unique situation in the US this year. Post-GFC and last year, the US fiscal deficit was the natural counterpart to private sector surpluses.”

See Part 1 – Saving-Investment balances in the great reflation, Part 2 – Duration Glut? , Part 3 – Financial plumbing: help or hindrance?

Head of Asia Pacific, Grant Wilson, also published a Substack blog: Is it to be Diem versus DCEP? “Diem, most typically associated with Facebook, is being pitched as a counterweight to DCEP. This is the start of a big conversation. The systemic implications extend to crypto, CBDC and USD as well.”

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, our Digital Currency Series, and/or our Covid research — please reach out to us here