Week In Review: On the Up and Up 14 May 2021

Week In Review: On the Up and Up

US equity indexes were down on the week: DJIA -1.1%, S&P 500 -1.4%, NASDAQ -2.3%. Wednesday had the largest drawn down in the indexes. See here for equity drawdowns in context looking at two-week periods since January 2018. For the Nasdaq it was a big, unusually quick move. On Friday, the indexes rallied but still finished lower on week. The catalyst for the sell-off was inflation fears hitting sentiment as US April CPI came in hot (see paragraph below).

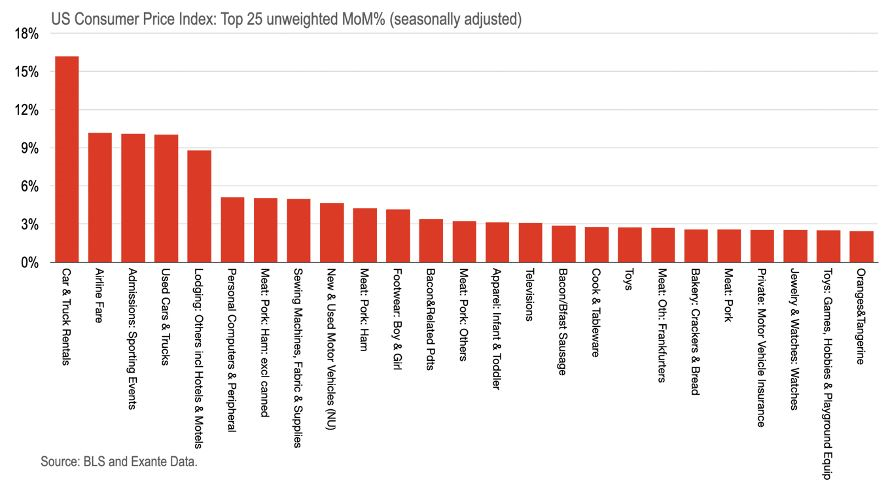

On the Up and Up: Senior Advisor Chris Marsh took a look at the CPI numbers: “The US Consumer Price Index (CPI) surprised sharply to the upside this week, recording 4.1%YoY (3.6% expected) with Core CPI at 3.0%YoY (2.3% expected.) The chart below shows the 25 largest price increases (MoM%) by individual product category. The 5 largest price increases were in car and truck rentals, airline fares, admission to sporting events, used cars and trucks, and lodging away from home (including hotels and motels.) Also noteworthy are the increases in prices of children’s clothing and footwear as well as toys and playground equipment.

In short, despite all the talk of commodity and traded good price inflation pressure, non-traded goods related to the re-opening of the economy, and travel in particular, are leading the way. That said, this is nothing to concern the Fed. A one-off repricing of services post-lockdown can be expected, but does not imply permanent inflation pressure.”

Chart: US April CPI – 25 largest price increases (MoM%) by individual product category

USD Comment

USD strengthened on the week. Risk-off sentiment lead to the first USD outperformance since March. The USD has outperformed 0.51% on our metric this week, about in line with the historical relationship (chart below).

The DXY Index ranged 90.02-90.87 – remaining above key 90.00 support. GBP was the strongest currency vs. USD in the G10. The high in Sterling was 1.4164. EURUSD ranged 1.2179-1.2053 – its failure to break higher kept the DXY Index above 90.00 support. JPY weakened vs. USD. The USDJPY high was 109.73 – the pair rose mid-week along with the US 10 year yield. Higher beta currencies AUD, NZD, and NOK also weakened vs. USD, impacted by the risk off sentiment. CAD was not as impacted and managed to appreciate vs. USD. CAD is supported by a less dovish BoC and an improving vaccination rate.

Coronavirus Update

Vaccine administrations in the EU continue to accelerate, and they are not far from 1% of the population per day. Compared to Q1, we are observing a very big (positive) difference.

Vaccine administrations in the US peaked just above 1% of the population back in mid-April and are now running around 0.6% per day. This week, the CDC said that adolescents ages ages 12-15 could receive the Pfizer-BioNTech vaccine. Adding teenagers to the vaccine roll-out may boost the US numbers a bit coming weeks.

The pace of vaccinations is also accelerating in China. The pace is now exceeding that in the US (chart below). If the pace continues, China’s speed of vaccination will also exceed that of the EU within a few days. China has seen the daily number of doses administered per 100,000 people surge from 439 six days ago to 704 now. The problem is that questions remain about efficacy of the local products used. Other EMs and frontier markets continue to vaccinate at a slow pace and have yet to see a pickup (chart below).

We have modelled how increased vaccine exports from the US and the EU (as local demand peaks) will impact countries around the world, from Latam to Asia and find the following: If the US (and the EU) start to allow exports in earnest in Q3, we should see dramatically accelerated vaccine roll-outs in a long list of countries.

Chart: Select Countries – Daily New Vaccine Doses Administered per 100k people (7d ave)

Exante Data Happenings & Media

Head of Asia Pacific, Grant Wilson, was on AusBiz talking Australia investment in China. Australian investors embedded a China sovereign risk premium as Australia investment in China fell by 25% last year – an unprecedented amount. In addition, Grant discusses the Port of Darwin issue. The interview is here – this is a chance to hear Grant speak somewhat at length on these topics. (Video is not behind a paywall).

Separately, you can read Grant’s column for The Australian Financial Review: Australia is divesting from China – here.

We held a client video call this week on “What Next for Asia Pacific”. We talked: regional vaccine rollout into Q3: The reverse cliff effect in action; US/China relations under the Biden Administration: Could tariffs be eased?; Macro outlook for Australia / New Zealand: Commodities, Tourism and Geopolitics. If you are an institution and interested in receiving a replay of the call, please reach out to us here.

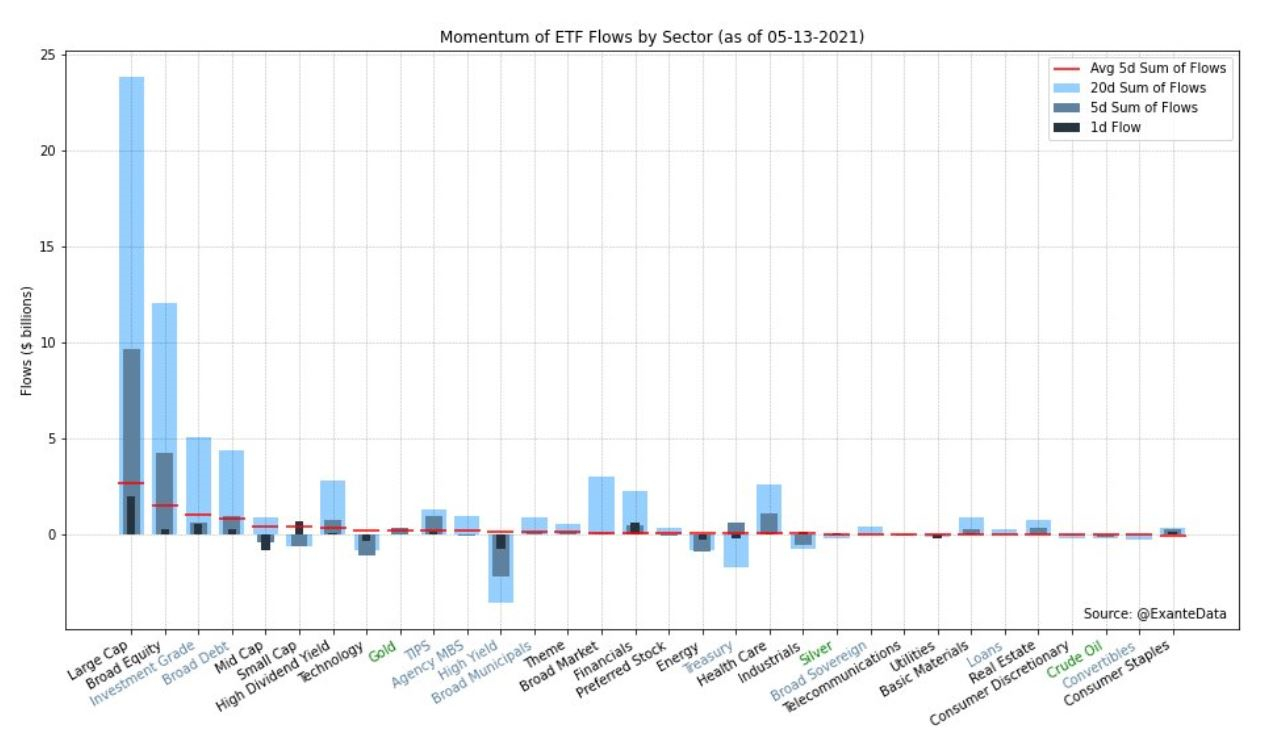

New Automated Tweet: We are automating a daily tweet of key ETF flows (chart below). Founder Jens Nordvig notes, “There is no broad-based trend of selling in ETF space. Inflows into large gap and broad equity ETFs are actually above normal this week (=buying the dip).” Follow us on Twitter here for daily charts and commentary updates.

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our most recent client video call, our Macro Strategy, Global Flow Analytics, Exante Data API services, Digital Currency Series, and/or our Covid / vaccine rollout research — please reach out to us here.