Week In Review: Keeping an Eye on the Delta. 2 July 2021

Week In Review: Keeping an Eye on the Delta

US equity indexes were up on the week: DJIA +1.0%, S&P 500 +1.7%, NASDAQ +1.9%. The S&P 500 hit a record high post the June payrolls report, released on Friday. June Payrolls came in at +850k – a bit higher than expected, but not a dramatic surprise overall.

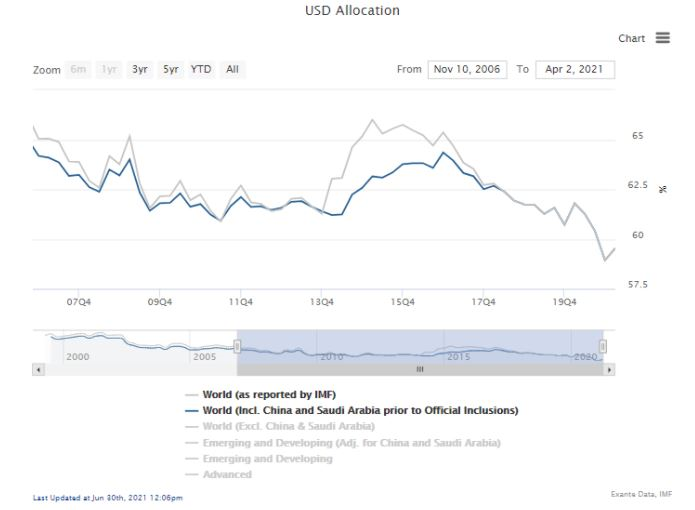

This week, Macro Strategist Fabio Palacio took a look at the updated COFER data: “After a dramatic decline in H2 2020, the USD share of global reserves bounced in Q1, partly due to valuation effects but also impacted by active USD buying by central banks. The bounce in the USD share only partially reverses a decline observed previously, and does not entail any meaningful bullish USD signal looking ahead. This is especially the case since leading indicators for Q2 do not point to strong official USD demand. In any case, relative to the bearish USD situation in H2 2020, the message now is more one of stability for official USD demand. Away from the USD, we saw active buying of CNY again in Q1 adding up to $20bn (the strongest since 2018). This could be relevant for the CNY outlook, especially in the context of reduced private sector demand.”

Chart: USD share of reserves bounced in Q1. Over the course of Q1 2021, the USD share of global FX reserves recovered somewhat to 59.5% from 58.9% in Q4 2020. This followed a substantial slide in the previous quarters.

USD Comment

USD outperformed this week, which was at odds with US equity market performance (chart below, yellow triangle). The DXY Index ranged 91.52-92.68. The high came on Friday, but then USD backed off a bit post payrolls and into the US holiday weekend. The DXY finished the week at 92.24. EURUSD ranged 1.1942-1.1820. USDJPY broke topside 111.00 this week – the high was 111.63 – this compares to USDJPY sub-103.00 in January. EUR, AUD, and NOK were the weakest vs USD this week and MXN was the strongest USD- see volatility adjusted returns here.

Chart: USD Relationship to Risk

Covid-19 Update: Delta Variant

Concerns about the delta variant and rapid spreads in countries such as South Africa, Indonesia and Australia are already triggering policy responses, mostly in the form of ‘lockdown lite’. We do not think that the delta variant will dramatically impact the time-table for reopening in developed economies.

Based on their research, Founder Jens Nordvig, and Strategists Martin Rasmussen, and Fabio Palacio conclude: “The UK time-table has been slowed on the margin, and concerns about the Delta variant will also impact international travel (including within the EU). But we would be surprised to see fresh restrictions impacting retail or restaurants. The vaccines are being rolled out quickly at the moment (near 1% of the population receiving a shot per day). For emerging markets, the conclusion is more nuanced. While we still believe that the ‘reverse cliff’ effect will have a dramatic and positive impact during Q3, the delta wave may still trigger policy steps / restrictions in the short-term, as we have seen this week in South Africa. For the US, we should note that case trajectories are no longer uniformly positive. We are seeing Delta-driven case growth in a growing group of states. But given that case counts are coming from a very low level, and given that fatality and hospitalization rates have been falling, we do not think it will generate notable policy intervention.”

For related charts – see Global Covid-10 Momentum, which compares the latest momentum in new cases with trend daily cases relative to peak levels, and “Who is vaccinating fast and slow in the EU?”.

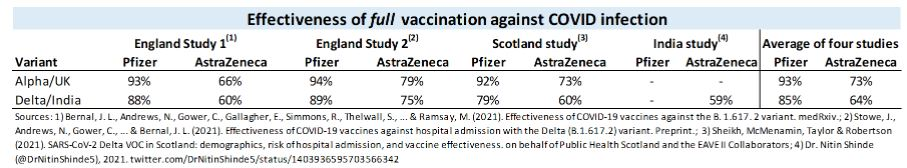

The Exante Data Team has also looked at academic evidence on vaccine efficacy – the best vaccines remain highly effective. Though vaccines protect less well against the Delta vs. Alpha variant, overall vaccine protection remains high – see table below.

Exante Data Happenings & Media

Last week, Founder Jens Nordvig published a Public Letter: The Reverse Cliff Effect for Vaccine Supply Will Allow Global Reopening.

Bloomberg cites Senior Advisor Chris Marsh’s Substack work on accelerating central bank balance sheets in Peak Central Bank Support Marks New Phase for World Recovery. Read Chris’s original Substack: The remarkable expansion of global central bank balance sheets during the pandemic.

Tourism Recovery: We recently launched our “Tourism” page on our data and analytics platform. It provides an overview of the state of the industry in key tourist destinations (Mexico, Thailand, Turkey, New Zealand, Malaysia and South Africa) and uses both coventional and alternative data.

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, Digital Currency Series, and/or our Covid-19 vaccine rollout tracking and Tourism Recovery tracking — please reach out to us here.