Week In Review: July 17, 2020

Week In Review

US equity indexes were mixed on the week. The S&P 500 and DJIA were up +1.2% and +2.3% respectively. Nasdaq fell -1.1% as major tech names were lower. On the positive side, investors focused on upbeat vaccine news. On the negative side, investors were concerned with rising coronavirus case counts as the US reported a new high of over 77,000 cases on Thursday (more below) and announcements of re-closings. Meanwhile, companies continue to self-monitor – the nine largest US brick-and-mortar retail companies, have adopted facemask requirements inside of their stores.

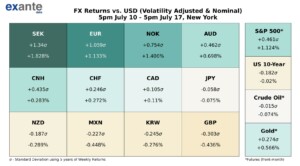

USD was mixed on the week (heatmap below). GBP depreciated the most vs. USD. EUR gained and closed the week above 1.1400 supported perhaps by some hope regarding the potential for positive news out of the EU Council special meeting. AUD was stronger, but ended the week sub-0.7000. 0.7000 – 30 remains strong resistance for AUDUSD. Higher beta SEK remained correlated with S&P 500 risk seeking sentiment and gained on the week. The DXY Index wavered above and below 96.00 support, finishing just above.

Turning to central banks, on Wednesday, the Bank of Canada left its policy rate unchanged as expected and said that asset purchases would continue at their current pace, including minimum purchases of $5bn/week of Government of Canada bonds – giving the Bank some flexibility. The BoC released a “central scenario” instead of its usual forecasts due to the high uncertainty about the outlook as a result of coronavirus. In addition, the BoC gave some soft forward guidance saying, “The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved.”

On Thursday, the ECB had no change in its monetary policy and the press conference was relatively uneventful. Lagarde emphasized that they intend to use PEPP in full (baseline). EURUSD stayed in a 1.1405 – 1.1423 range for the announcement and press conference.

Today: European Council special meeting in Brussels – day two. Leaders are discussing the plan to respond to coronavirus. A Twitter poll conducted by Founder Jens Nordvig showed no consensus by respondents as to whether and when the EU-27 could agree on EUR500-750bn in extra budget capacity for pandemic relief. Watch for headlines at the press conference today, which could impact Euro at the Asia open Sunday.

Ahead – select earnings reports and economic releases:

Sunday, July 19: PBOC Loan Prime Rate; Monday, July 20: NYC moves to modified Phase 4 re-opening; Australia RBA Minutes, RBA Gov Lowe speaks; Tuesday, July 21: Canada: Retail Sales (May); NZ global dairy trade price index; Wednesday, July 22: Canada CPI (Jun); US Existing Home Sales (June); Thursday, July 23: US initial jobless claims (weekly); NZ Trade Balance (June); Friday, July 24: UK Retail Sales (June); UK Manufacturing PMIs; German Manufacturing PMI (July). Earnings releases: KO, TSLA, MSFT, TWTR, INTC

Covid-19 Growth: US States

The heatmap below shows the trend of daily growth in confirmed coronavirus cases among US states, along with the trend of daily testing hit ratios. As of 17-Jul-20 the median daily case growth rate as of is 2.0%, and the median hit ratio is 6.1%. Case growth continues to moderate in California, Arizona and in Texas, though the latest read ticked higher, it is below the growth rate 5-6 weeks ago. However, trends are deteriorating in other states: Georgia, Louisiana, and Tennessee. These states have seen trend increases in growth and hit ratios. The most rapid growth is now seen in Alaska, Montana, and Idaho. The acceleration of case growth in Alaska is especially clear in the heat map below (blue to red). With case growth broadening beyond early 2nd wave/Sunbelt states, the US posted a new high in cases nationally this week. For chart updates and commentary, follow us on Twitter.

Media

- Founder Jens Nordvig joined Tom Keene on Bloomberg Surveillance on July-13 to talk about USD, EUR, EU Recovery Fund, US-China tensions, and central bank reserve management.

- Senior Advisor Brad Setser participated in the Council of Foreign Relations’ Virtual Meeting Dedicated to Martin Feldstein: World Economic Update. Setser was critical of the IMF’s failure to do more to help its members and the world face the current shock. In addition, he highlighted that China was a potential downside risk to the global economy in H2.