Week In Review: Big Bets. 30 April 2021

Week In Review: Big Bets

US equity indexes were slightly lower on the week: DJIA -0.5%, S&P 500 0.0%, NASDAQ -0.4%. However, the S&P 500 and NASDAQ reached new highs prior to giving up their gains on Friday. US economic data were strong – personal income in March surged 21.1% at a monthly rate reflecting the arrival of stimulus checks. Personal consumption expenditure rose 4.2% on the month. The economic rebound is both supporting market sentiment and causing some worries about rising bond yields, which results periodically in a pullback in equities.

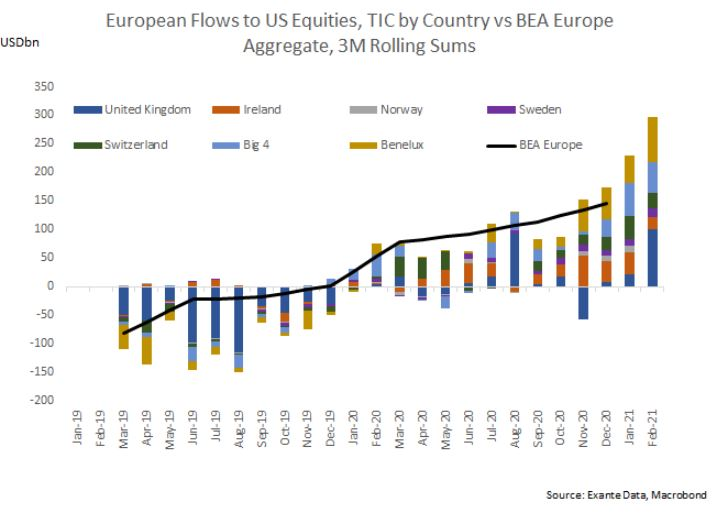

In last week’s note, we wrote about one under-appreciated aspect of US equity indexes’ stellar run-up post the pandemic-panic – the support provided by foreign investors. Foreign inflows into US equities were historically elevated in 2020 at around 3.5% of 2020 GDP. So far in 2021, these trends have mostly persisted or even accelerated – monthly TIC data for January and February show foreign purchases of $152bn and $146bn respectively.

Who is betting big on US exceptionalism? Work by the Exante Data Team shows that the largest portion of these foreign inflows into the US have been from European investors. Total portfolio equity outflows from the Eurozone have also been historically elevated, and account for ~60% of overall inflows in 2020.

Our Exante Data Team points out, “We note the elevated European flows to foreign (US and RoW) equities have increased the US and foreign allocation in overall investment fund portfolios, while the domestic allocation to equities has been relatively stable. European investment funds are historically overweight equities overall, but the US equities allocation is the one that sticks out, having moved from 11% in 2018 to 14% before the COVID crisis and 16% since.”

Big Bets: The chart below shows equity portfolio flows from the monthly TIC data for the major European sources against the quarterly (lagged) European aggregate from the US BoP (black line). It suggests that European purchases of US equities have remained VERY strong into Q1 2021, with the latest monthly data for February showing large equity purchases from the UK as well as the Benelux countries.

USD Comment

USD was stronger on the week, with its gains coming on Friday. Though the DXY Index reached a one month low this week, it retraced on Friday, pushing well through 91.00 resistance to end the week at 91.30. The slightly odd price action likely reflected (unpredictable) month-end dynamics. With the S&P 500 flat on the week, the dollar generally traded in-line with the signal from risk assets. Prior to the USD bounce-back, EURUSD broke topside 1.2100, reaching a recent high of 1.2147. The single currency ended the week at 1.2017. JPY was the weakest of the G10 vs USD this week. It ranged 107.65-109.33. CAD performed the best vs USD. USDCAD ranged 1.2488-1.2268 – with the low on Friday.

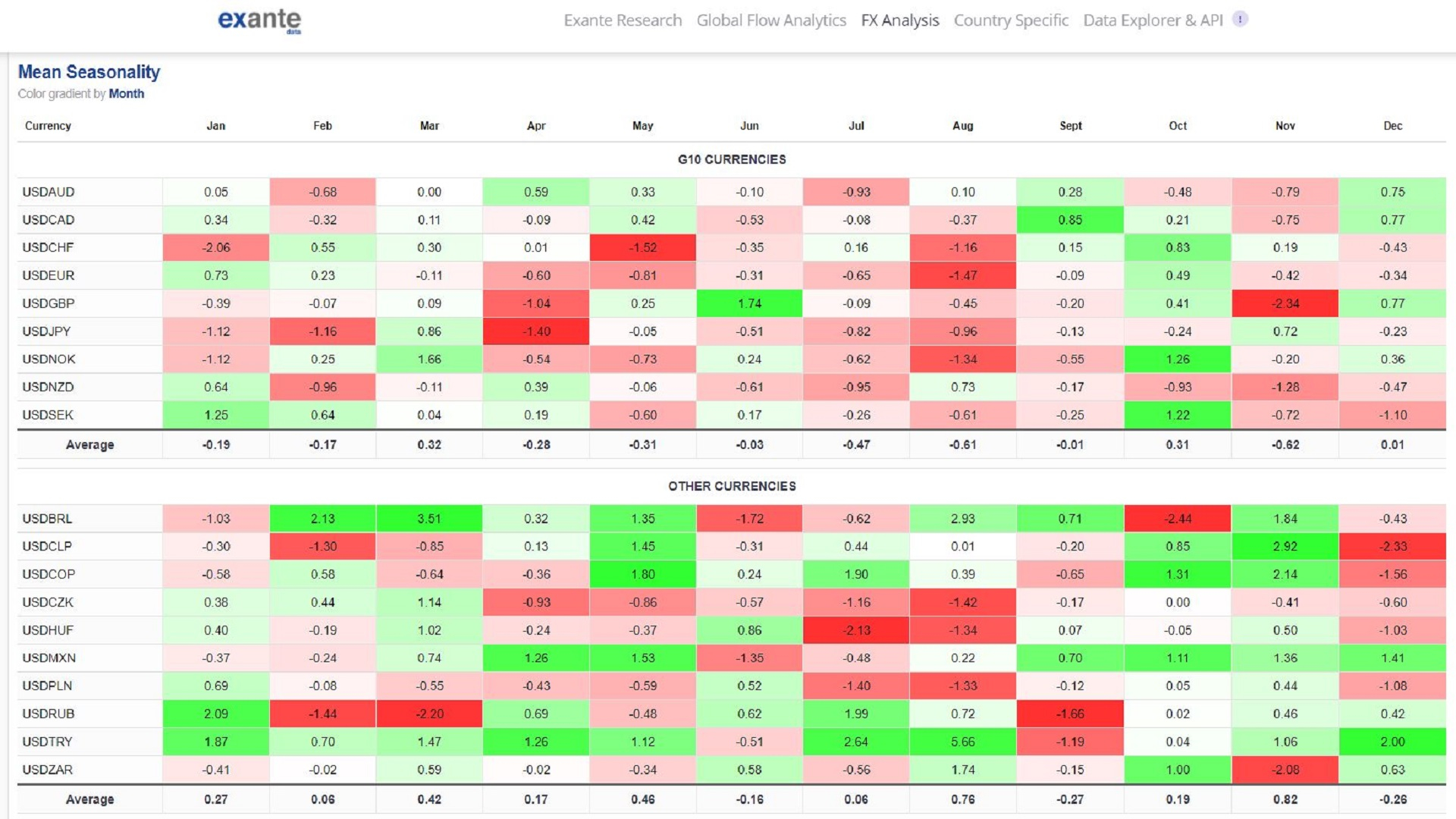

Since it is the start of May, we take a look at USD May seasonality from our proprietary FX factor model (table below). In May, USD is weaker on average vs. G10 currencies. It is especially weak vs. CHF. It is weak, but less so vs. EUR, NOK and SEK. USD is slightly stronger vs. AUD, CAD, and GBP. USD performs better vs. EM FX in May – it strengthens on average. It is especially strong vs. BRL, CLP, COP, MXN, and TRY. USD is weaker vs. Eastern Europe FX: CZK, HUF,PLN, and RUB.

Coronavirus Update

Exante Data Happenings & Media

Founder Jens Nordvig was referenced in this Bloomberg article: The Two Big Themes In The Crypto Market Right Now by Joe Weisenthal. Here is the market “joke” that Jens referred to – the most interesting thing in macro right now.

This week, we are initiating tracking of flows related to bunds on our data and analytics platform and will be adding the Buba balance sheet data in coming days.

Senior Advisor Amelia Bourdeau appeared on Market Think Tank talking about Europe re-opening. Here is a clip.

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, our Digital Currency Series, and/or our Covid research — please reach out to us here