Week In Review: A Second Vaccine. 18 December 2020

Week In Review: A Second Vaccine

US equity indexes were higher on the week: DJIA +0.4%, S&P 500 +1.3%, NASDAQ +3.1%. All three indexes hit all time highs. Optimism that an additional US fiscal stimulus deal will get done along with continued positive news on the vaccine front supported sentiment. The medium term outlook seems brighter now that the vaccine rollout is underway. In addition late Friday, the FDA issued emergency use authorization for Moderna’s Covid-19 vaccine. There are now two vaccines in the US approved and available for emergency use – the first was the Pfizer/BioNTech vaccine.

Bitcoin crossed $23,000 for the first time ever this week. Founder Jens Nordvig published a new Substack blog – What is good Money? He notes that sustaining purchasing power is key to “good” money. He asks, “Should the government have a say in managing (your) money, or is a decentralized system, such as bitcoin better?” Noting the recent run-up in Bitcoin, Jens writes “There is a group, partly overlapping with the gold-bugs, arguing in this direction, and increasingly putting money behind the view (in part due to lack of nominal return on traditional liquid forms of money.)”

There is heated debate about governments’ inability to keep money safe. But many investors/savers nevertheless have one-sided exposure to their own country’s money. Ahead, we plan to write more on “good money” on our Substack. Jens notes, “We will comment more on home bias (lack of diversification) of money/currency portfolios and plan to add a gold/bitcoin dimension to the analysis.”

Subscribe to our Substack here so you don’t miss out — its free. We look forward to having a lively debate on these important macroeconomic topics – join us!

Ahead Next Week: Select economic releases: Sunday, Dec 20: PBoC Prime Lending Rate. Monday, Dec 21: NZ Westpac Consumer Sentiment Q1, Australia Retail Sales. Tuesday, Dec 22: UK Current Account Q3, UK GDP Q3, US Q3 GDP, PCE Prices Q3, US Existing Home Sales (Nov), BoJ Monetary Policy Meeting Minutes. Wednesday, Dec 23: US Personal Income & Spending (Nov), Canada GDP (Oct), US Initial Jobless Claims, US UMich Consumer Sentiment (Dec), US New Home Sales (Nov). Thursday, Dec 24: Holiday – UK/Germany/Canada/NZ/

USD Comment

USD was broadly weaker. DXY Index broke key support at 90.00, putting in a low of 89.73. GBPUSD traded above 1.3600 on the hope of a Brexit trade deal. At the time of writing, negotiations are still ongoing. EURUSD high was 1.2271 on Thursday as risk seeking got a boost and USD weakened. The major US equity indexes reached record highs Thursday boosted by hopes of additional US fiscal stimulus and the fact that the FDA panel endorsed Moderna’s coronavirus vaccine. Higher beta FX: SEK, NOK, AUD and NZD gained.

Coronavirus Update

International: There is growing concern in Europe about a re-acceleration in cases following the relaxation of lockdown measures. This is evident from our heatmap of w/w case growth in Denmark, Ireland, Spain, Czechia, Slovakia, the Netherlands, and UK – see heatmap with individual countries here. Germany pursued lockdown lite and did not see the descent in cases experienced elsewhere. As a result, Germany took additional restrictive measures, which started Wednesday. Speaking Friday, UK PM Johnson said he was “hoping to avoid” another national lockdown but noted that Covid-19 cases have increased “very much” in recent weeks. He will hold a coronavirus press conference today, Saturday, as a new strain of coronavirus “is spreading in the south-east of England.” (reported by The Guardian.)

Charts: Germany and UK: Daily New Covid-19 Cases. Red bar = peak. Parenthesis = cumulative cases.

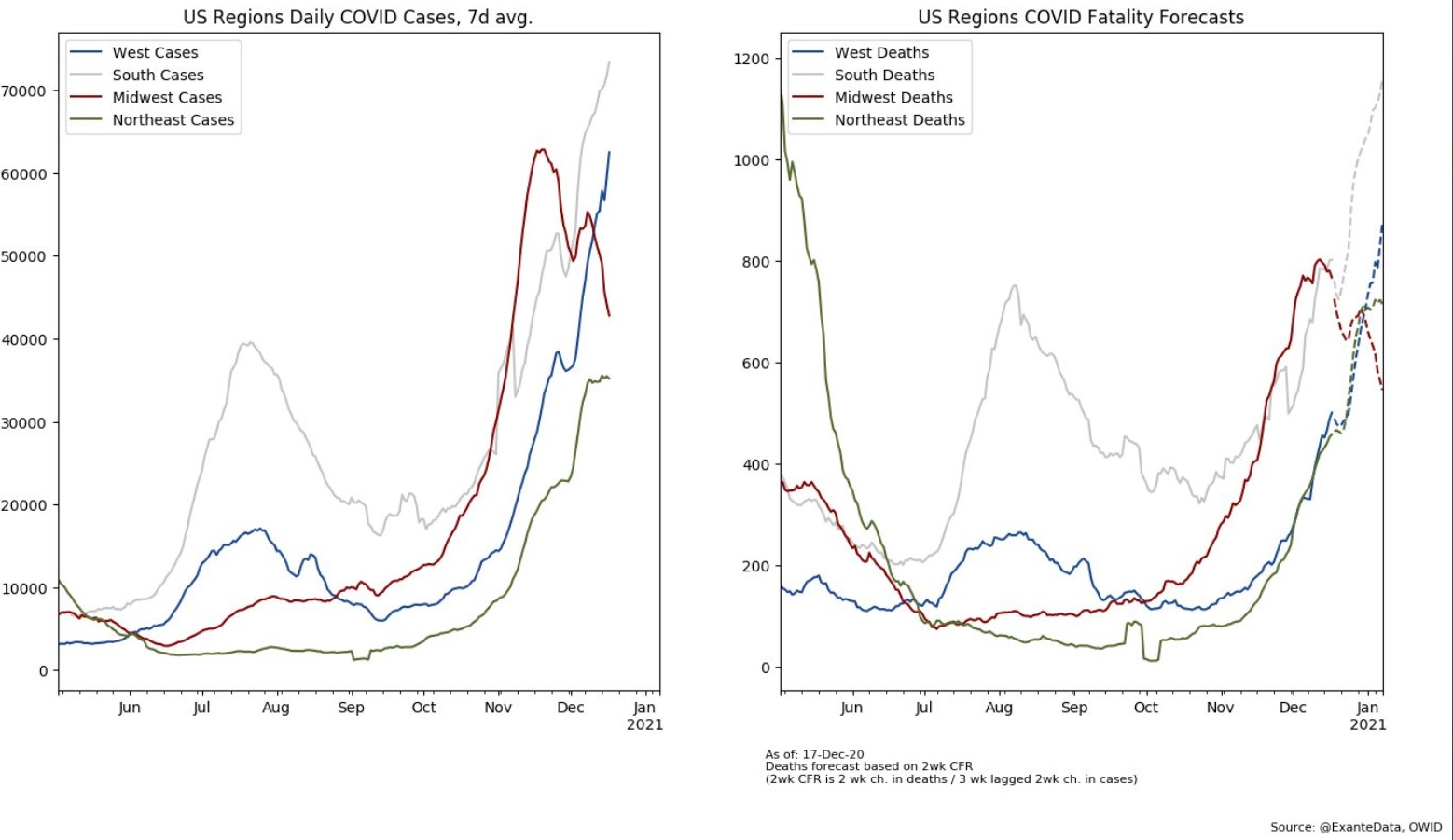

US: The Midwest is bringing Rt down notably, with sustained negative growth in new cases in Michigan, Illinois, and Ohio, for example, as policy measures take effect. It is a different story in California, and Tennessee, unfortunately, with no break in the upward trajectory. See heatmap of w/w growth rates in US states here. Fatalities in the Midwest are about to peak, but fatalities are set to continue to rise in the West, Northeast and the South (chart below).

Exante Data Media

We have been featured in quite a few media spots recently. Jens has had helpful conversations on timely and important market topics. Some even hint at projects we are diving deeper into for the start of the new year. We summarize and link to recent media below:

On 4 December, Jens was on CNBC’s Powerlunch talking USD, Gold, Bitcoin, and alternative safe havens.

In Part 1 of Jen’s 7 December Bloomberg TV appearance, he talks EURGBP and long-term consequences of Brexit on UK economy from the hit from lack of access to big services market in the EU.

In Part 2 of Jen’s 7 December Bloomberg TV interview, he talks USD medium term view, China’s Balance of Payments, and discusses whether China is intervening in the FX market.

On 14 December, Jens spoke with Bloomberg’s Joe Weisenthal about Money, Inflation, and our Substack blog project.

If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, and/or Exante Data API services — please reach out to us here.

Thank you for reading our Week In Review in this remarkable year. We appreciate your support and engagement! The Team here at Exante Data wishes you a happy holiday season and a healthy and fun 2021!

This note will be on a brief holiday hiatus – it will return January 2, 2021.