Week In Review: A Race to the Finish Line. 26 March 2021

Week In Review: A Race to the Finish Line

US equity indexes were mixed on the week: DJIA +1.4%, S&P 500 +1.6%, NASDAQ -0.6%. On Friday, the S&P 500 had a late-trading session rally that pushed it to a new high. Looking back, March 23 was the one year anniversary of the S&P 500 2020 low.

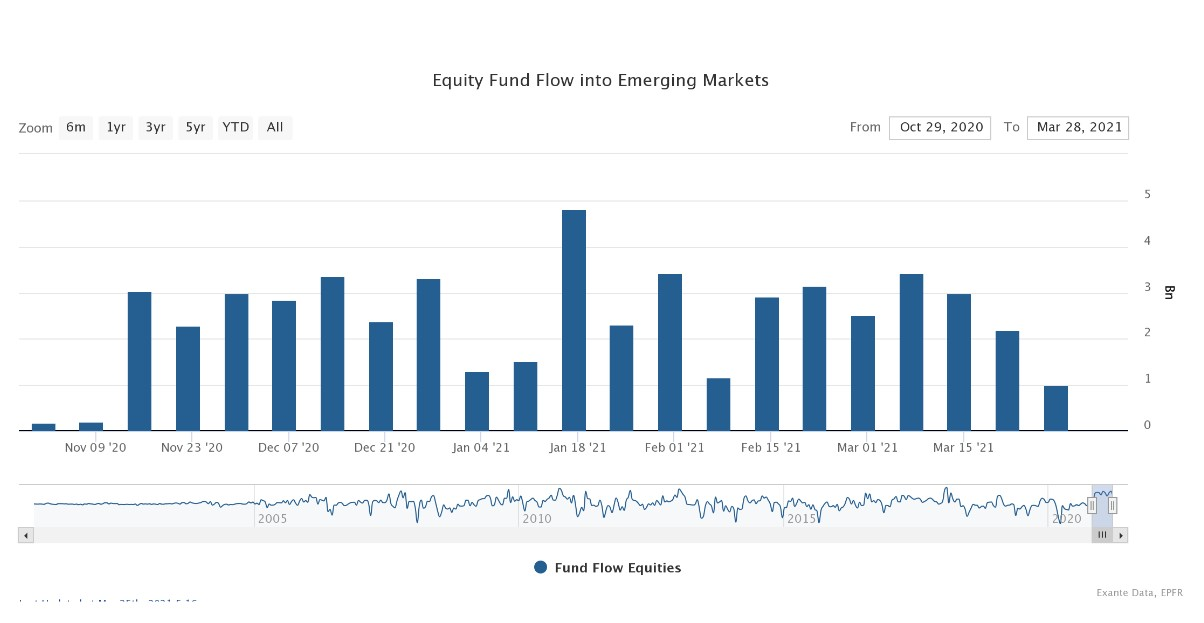

Investment into Emerging Market ETFs and mutual funds moderated this week as did US flows into international (EM & DM) ETFs and mutual funds (charts below). Senior Strategist Alex Etra notes, “Given the moves we have seen in the USD, the US yield curve and equities more broadly this suggests a combination of COVID-related concerns about global growth and perhaps institutional investor portfolio rebalancing around quarter-end may have dented sentiment towards risk assets (foreign equities). But overall the fact that we see continued US investor engagement with international equities suggests that investors are maintaining a risk-positive medium-term view given the expected vaccine driven recovery in the global economy.”

Senior Advisor Chris Marsh on the International Monetary Fund (IMF): “Last week, the IMF endorsed a USD650bn SDR allocation, to be distributed by capital key across members once formally approved during the Spring Meetings in two weeks. SDRs can be accessed by converting into hard currency off market at the SDR Department of the IMF. The last such allocation amounted to USD250bn in 2009, in the aftermath of GFC. This week’s agreement is another sign of the multilateralism of the US Treasury under the Biden administration. But there could yet be a twist if this generosity is coupled with stricter surveillance over reserve asset accumulation and managed floating of exchange rates. About 60 percent of this allocation goes to countries with no need for gross reserves, meaning only USD270bn goes to emerging and frontier markets. This amounts to as much as 11 percent of gross reserves for Argentina, 6.7 percent for Turkey.”

USD Comment

The USD strengthened on the week. The DXY Index had a high of 92.89 – its strongest level in four months. The USD significantly outperformed the impulse from global rate differentials. In addition, the flow picture is supportive of USD strength as equity outflows moderated this week (see above). EURUSD fell below 1.1800 – the low was 1.1761. GBPUSD ranged 1.3873-1.3671. USDJPY ended the week above 109.00 at 109.67 – the high for the week was 109.80. AUDUSD ranged 0.7755-0.7564. NZDUSD fell below 0.7000 – the low was 0.6944 as NZD was hindered by the NZ government announcement aimed at slowing house prices.

Next week is the start of April, so we take a look at FX seasonality from our proprietary FX factor model. It shows that against G10 FX, the USD, on average, is weaker in April. USD is especially weak vs. JPY and GBP. It is weak vs. EUR as well, but not by as much. However, it is stronger vs. AUD and NZD. Turning to EM, the USD is stronger vs. MXN and TRY seasonally in April. It is weaker vs. CZK. See our FX seasonality table here.

Coronavirus Update

US Update: Michigan, similarly to Europe, is struggling with new covid strains. Covid cases in Michigan are up 59% w/w. Most other US states look ok, though New Jersey is also concerning. The Detroit Free Press reports on the alarming trend “emerging as coronavirus hospitalization rates in the state [Michigan] this month are surging among younger people, a group with the lowest vaccination rates among the state’s populations…” See US state charts of new daily covid cases here. You can see international charts for new daily covid cases here.

Founder Jens Nordvig notes, “The speed of vaccinations in the US will be crucial as to whether certain states (with problematic strains) will have problematic final waves or not…The good news is the the pace of vaccinations is accelerating rather impressively in the US at the moment. The bad news is that some states have a high proportion of new problematic strains. Hence, it will be a race to the ‘finish line’ in some states in this pandemic.” See US total vaccines administered here.

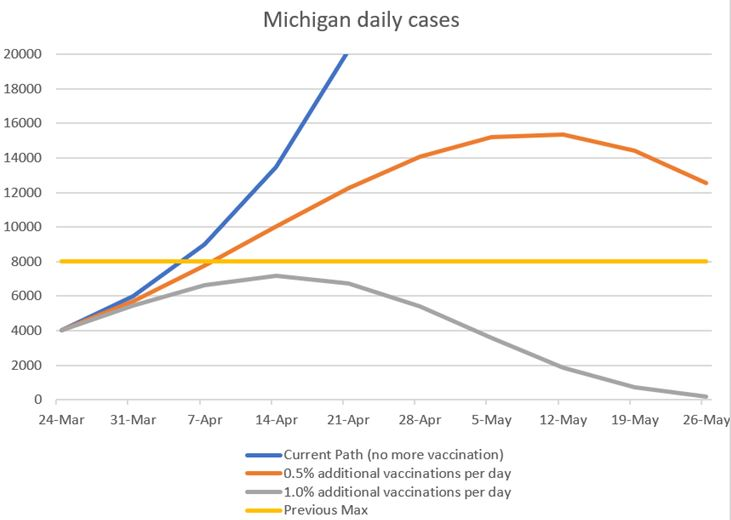

Left unchecked, cases in Michigan – the state where case growth is the most worrying – would skyrocket in coming weeks. But there are reasons to be optimistic. The Exante Data team modelled Michigan’s R0 (how many persons an infected person infects) across two different vaccination roll-out scenarios: 0.5% of the population get vaccinated (with a single dose) per day vs. 1.0% per day. In the last week, 0.76% of US citizens have received a dose per day on average. Even if the roll-out does not accelerate further, the outbreak in Michigan would probably peak slightly above it’s previous max in April or May — see chart below.

This means that even in those states where outbreaks have the worst trajectories, vaccinations should prevent exponential growth. Taken together, the COVID-19 situation in the US looks set to stay under control. That should allow the reopening to progress and services to rebound.

Exante Data Happenings & Media

Senior Advisor, Chris Marsh, wrote a new Substack blog. It has a long-term historical perspective on the US financing challenge; linking all the way back to the days of war financing: To catch a falling knife: US Treasuries and the Fed (Part 1). Saving-investment balances in the great reflation.

Head of Asia Pacific, Grant Wilson, has a new opinion column in the Australian Financial Review, which is generating some comments: Crypto is being pumped and dumped . “At the risk of incurring the not insignificant wrath of the cryptocurrency community, a few home truths are in order,” writes Grant. “Crypto can and will have do better than this if the ecosystem is to evolve into anything like the utopian visions that are being brandished around.”

We held a client video call on: Final Thoughts (Hopefully) on Global COVID Trends.

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, our Digital Currency Series, and/or our Covid research — please reach out to us here.

*This Week In Review note will be on hiatus next weekend and will return Saturday, April 10th.*