Week In Review 6 November 2020

US equity indexes rose strongly this week: DJIA +6.9%, S&P 500 +7.3%, and NASDAQ +9.0%.

At the time of writing on Saturday, major news networks are calling the US Presidential Election for VP Biden. However, during the past week post- US Election Day and while markets were open, the US Presidential race had not been called. US equities rose despite this uncertainty, perhaps on a combination of getting through the event itself and hope that a winner would be announced soon. Control of the Senate has not been settled yet with key seats in Georgia headed for a run-off.

Ahead Next Week: Select economic releases: Sunday, Nov 8: China Composite PMI. Monday, Nov 9: Germany Trade Balance and Current Account (Sep), Australia NAB Business Confidence (Oct), China CPI (Oct). Tuesday, Nov 10: UK Claimant Count Change (Oct), German ZEW Sentiment (Nov), EZ ZEW Sentiment, Australia Westpac Consumer Sentiment (Nov), RBNZ Monetary Policy Decision. Wednesday, Nov 11: Japan Foreign Investment Stocks/Bond Buying, ECB Forum on Central Banking (schedule here). Thursday, Nov 12: UK GDP (Q3), UK Goods Trade Balance (Sep), German CPI (Oct), ECB Forum on Central Banking – will feature a policy panel Thursday with BoE’s Bailey, ECB’s Lagarde, and Fed’s Powell. US Initial Jobless claims, US Core CPI (Oct), Friday, Nov 13: EZ GDP (Q3), EZ Trade Balance (Sep), US U of Michigan Consumer Sentiment (Nov).

USD Comment

With US equity indexes up on the week, USD broadly weakened. However, given the strong rise in the S&P 500, it was surprising that USD was not weaker than it was. DXY Index started the week at 94.26 and ended at 92.23 – around the week’s low. 92.00 is support. Higher beta currencies NOK, SEK, AUD, NZD, MXN benefitted from the equity rally. EURUSD range: 1.1614-1.1885. GBPUSD range: 1.2860-1.3171 (Friday high). As the week wore on with US swing states counting votes, JPY strengthened falling sub-104.00 to a low of 103.21. As it is the start of the month, you can see our USD November Seasonality from our proprietary FX factor model here. USD is weaker in November vs G10 FX.

Coronavirus Update

US: The US 3rd wave continues to broaden and accelerate with new cases accelerating past 100k per day in recent days and fatalities rising to more than 1500 on Thursday. While the most severe outbreaks remain in the Dakotas, there are signs that we may again need to keep an eye on major population centers where hospital pressure is likely to be the key driver of policy-tightening and self-policing. Here is the heatmap of US states’ trend daily growth in confirmed coronavirus cases.

Our analysis suggests there is a possible link between temperature and case growth in the US. The overall sense is that with temperatures dropping, it is likely that Rt in the US will rise, increasing the likelihood for greater case growth in coming weeks. We have been seeing this in our daily tracking in the Midwest and increasingly the Northeast. Additionally, we can see that self-policing plays a role in bringing Rt down, but the lesson from Europe is that stricter methods (though not necessarily nation-wide lockdowns) are critical to setting a peak in cases.

International: As we track case momentum in Europe, we observe that Western Europe is on a path that starts to look better. Specifically, the UK continues to improve and Ireland is seeing solid fall in case growth. Italy’s momentum is better recently (but still accelerating). France is a bit better though the turn is shaky there. In Eastern Europe, Czech Republic still looks good, while Poland also showing a bit better (though still accelerating) momentum. Hungary’s situation is more tenuous. You can see our grid of week-on-week growth of new cases (not cumulative cases) to get a fast read on whether policy measures are starting to work here.

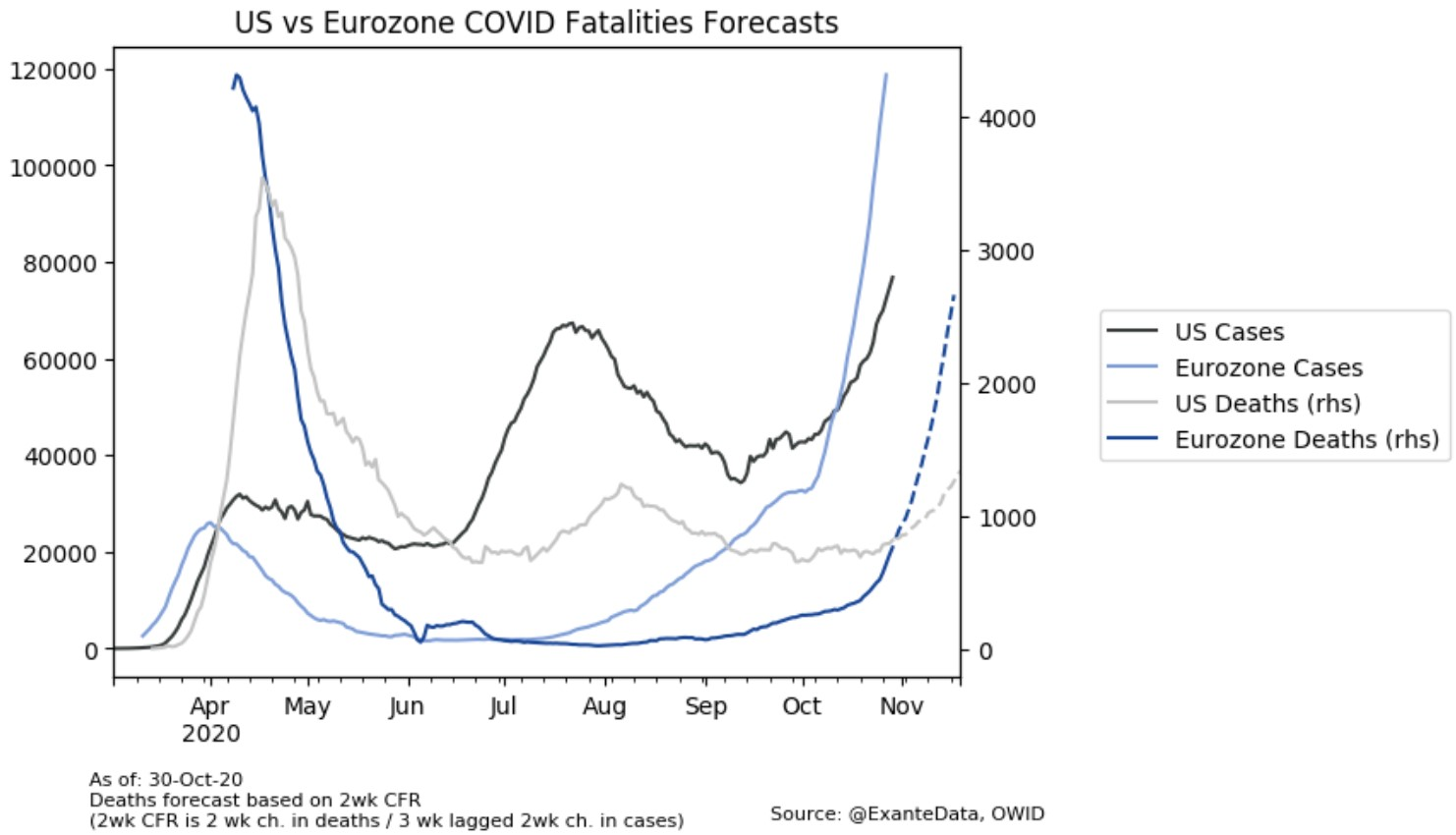

As cases continue to surge in Europe, our deaths forecast is now over 3,000 per day by late November, and the realized deaths are surpassing the US for the first time in many months (as projected over the last few weeks). There are signs in recent days (driven by decelerating case growth) that the trajectory of expected fatalities will start to flatten by early December.

Media

Founder Jens Nordvig appeared on CNBC at around 5:30pm EST on Election night and discussed the outlook for USD and the importance of the Senate outcome.

Head of Asia Pacific Grant Wilson appeared on Auz Bis at around 9pm EST on US Election night to discuss results so far and what could be in store ahead for markets.

For more information on our Macro Strategy, Global Flow Analytics, and/or Exante Data API, institutions please reach out to us here.