Letter: Asset Management vs Asset Ownership

Dear Friends and Colleagues,

We have transitioned from a stimulative policy regime that boosted asset values (and which was possible when inflation was low) to a regime of persistently higher inflation and no central bank “put” in sight.

In the prior regime, asset ownership paid off almost regardless of which asset you owned. Today, active asset management with a macro component is crucial. It is the only way to generate respectable returns, given the power of the global macro shocks in motion.

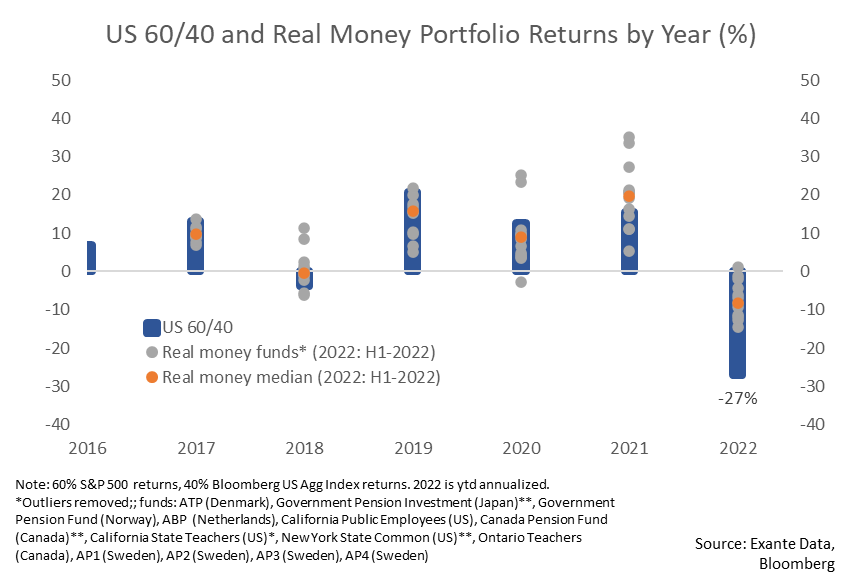

The chart below shows how some of the world’s largest asset owners (pension funds) have seen returns suffer in 2022, in line with the challenges for the traditional 60/40 portfolio

The COVID shock, historically large monetary and fiscal stimulus, and an unprecedented war at the border of the EU has changed everything and macro shocks are now dominating market dynamics for all assets.

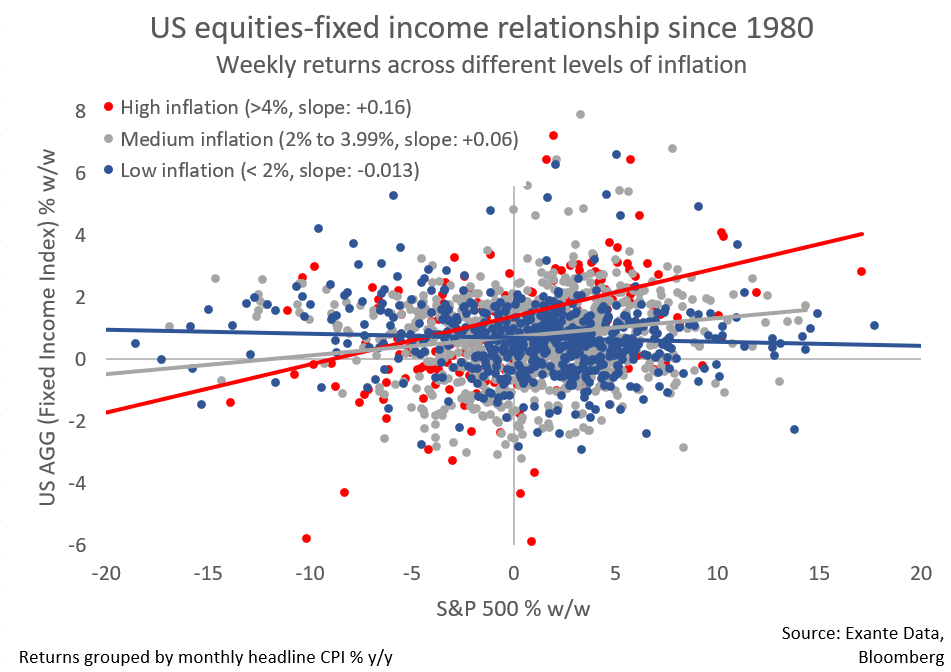

The chart below shows how asset markets behave when inflation is low and when inflation is high.

In the low inflation environment, there is a tendency for bond and equity returns to be uncorrelated (or even slightly negatively correlated). In other words, if equities are down, your bond investments will do much better (these are the blue dots)

In the high inflation environment, there is a tendency for bond and equity returns to be positively correlated. If you lose on your equity exposure, you also lose on your bond exposure (these are the red dots).

|

For example, in September, the HFRI 500 Macro index jumped 2.75 percent, reaching a year-to-date performance gain of 17.5 percent, according to Institutional Investor (link). This implies outperformance relative to the traditional 60/40 portfolio of by 30-40% so far in 2022.