Jens Nordvig: Tweet Thread 1 on Evergrande. 18 Sept 2021

Below is a Tweet thread written by Founder Jens Nordvig on September 18, 2021. We are publishing it on our website given that Evergrande is a hot topic. This tweet thread had 3.4 million views:

There is a huge amount of focus on China contagion/Evergrande at the moment. Hence, it is a time to be precise. I will not do a comprehensive thread (yet). But just provide some specific color on the High Yield credit moves, which themselves are generating a lot of attention.

It is true that China (USD) credit indices moved a lot last week, after stabilizing briefly in early September. And there are lots of fintwit comments on that: Here is a good (and sober) example.

It is worth thinking about what is going on under the surface, so I am going to plug in the first 10 names (highest weight in the index) and let them tell the story: The first one is Bank of Communications (2.4%) weight in HY index. Yield is very stable. Not much contagion here.

The second on is Kaisa Group Holdings (a real estate developer), with 1.4% weight in HY index. Yield is exploding, past the high from end-July (Evergrande fears clearly spreading here)

The third one is a specific Evergrande bond that is trading at 59% yield (price 26.6 vs par), this has 1.1% weight.

The fourth one is Lenovo (which took over IBM hardware assets as many know some years back), the specific bond here is 0.9% weight in index. nothing to see here:

The fifth one is Well Hope (consumer electronics). 0.8% of index. Yield has been grinding up for some months, but not obvious it is Evergrande linked.

The sixth one is Sunac (also a real estate company), it is 0.7% of the index on the specific bond, and the yield is exploding (no surprise, real estate contagion is in motion, in the sector)

The seventh and eight bond in the index are also Kaisa group (together adding up to 1.4% of the index), but we showed Kaisa already (#2), so let’s move to the ninth: ENN Clean Energy: nothing to see, stable yield

The 10th biggest (and 11th biggest) bond in the HY index is Fortune Star (a financing company), together they are 1.2% of the index. Yields are pretty stable in a range.

I will stop showing individual bonds here, and instead look at the index composition: The Bloomberg China HY USD index is 66% real estate. Hence, when you look at the aggregate index, it is mostly a real estate picture you get.

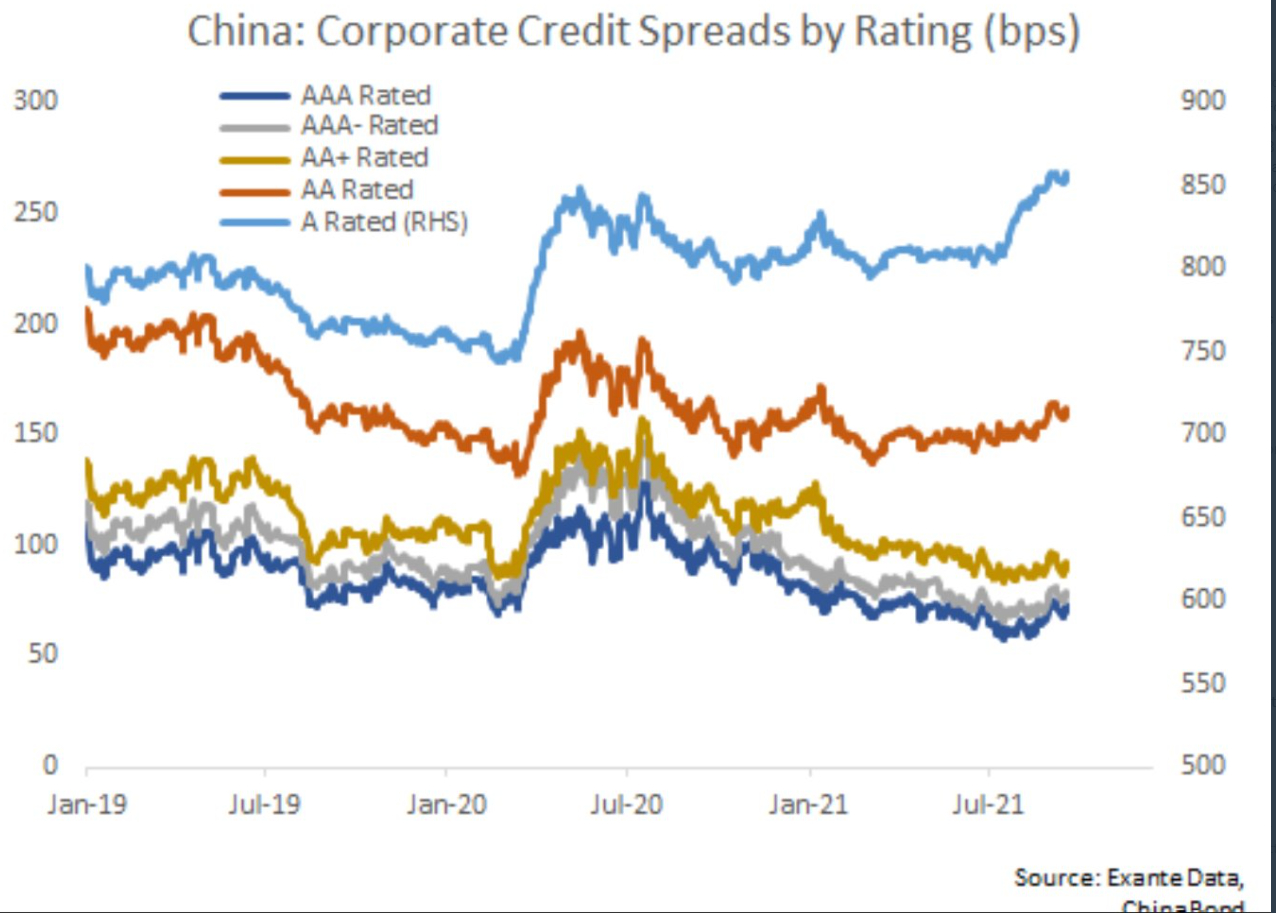

If you dig into the other parts of the index, the message is quite different (at least for now). It is hard to find (big) companies outside real estate that have seen significant spread widening. This is also the message from higher grade indices (note: not USD based): stable

This is not to see that ‘everything is fine’. It is just to be precise about what type of contagion we are observing. Sector specific or broader; real or financial. So far mostly real estate specific (with some iron ore impact too).

China is a special case (always). So we cannot use the same template as we have used in the US in 2008, or other past crises. The banks will be dealt with differently and pricing signals (including from the housing sector) may not be entirely ‘market driven’.

I will leave it at that. Watching China contagion is very important now, and while it is unlikely to be a ‘banking crisis’ like the Global Financial Crisis, there could be other types of ‘real contagion’. We just have to monitor it very precisely.