Announcing our new CTA flow prediction models + Application to UST yields spike this week

Dear Friends and Colleagues,

We are constantly adding new data and product lines to our service. Today, we are pleased to announce the launch of a new quantitative tool. This tool allows clients to track and predict the behavior of certain systematic investors (known as CTAs). As they grow larger and more sophisticated, it is vital to understand their positioning and get ahead of their likely flows.

For example, early this week, the models pointed to very strong pending duration selling pressure from CTAs (as illustrated in our rare tweet on the topic below). The actual pressure has since materialized, and played a significant role in the outsized spike in US bond yields this week

.

We have been working with CTA models for some time. But in September 2019, we significantly enhanced our CTA models and the corresponding interface on the website. We are thrilled to launch version 2.0 of our CTA model which now covers a broader set of asset classes (FX, FI, Equity, Commodity), totaling 83 instruments.

The table below provides a snapshot of where fixed income positions are heading in different price scenarios in coming weeks.

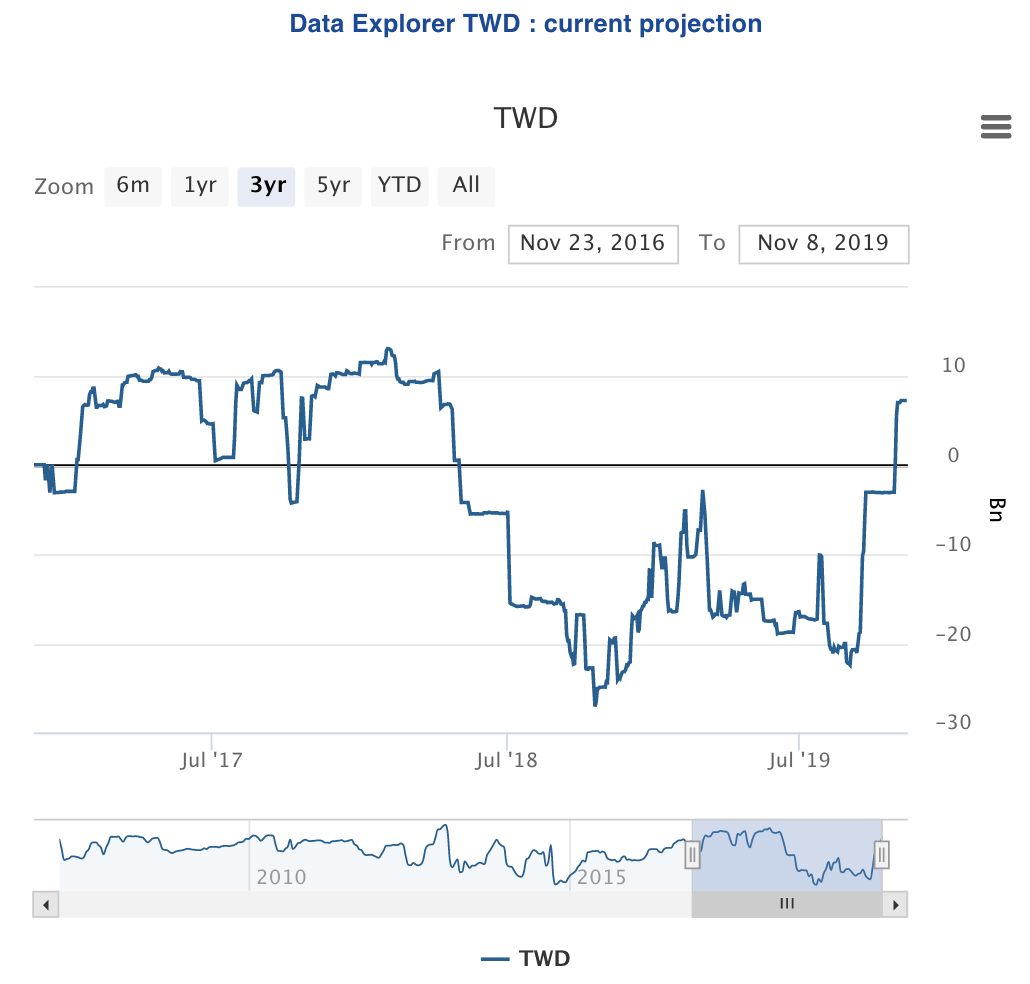

The chart below shows how TWD buying by CTAs is likely to have added to TWD appreciation pressure in recent weeks:

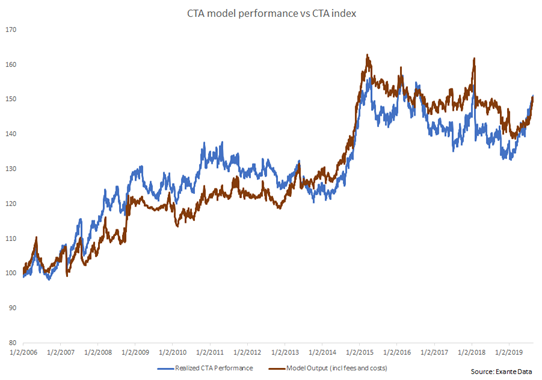

In a recent primer (available upon request), we provide more detail on our latest CTA models, including some of the findings from our backtesting and model validation exercises. As explained in the primer (and the chart below), we believe our model does a robust job of tracking CTA investor performance. Importantly, our models have an edge over the widely used CFTC positioning data, as they are updated daily with the latest market prices and our clients can receive daily CTA position summaries via email with forward looking projections.

If you are interested in learning more about our CTA models (or would like to request a copy of our primer) or our Global Flow Analytics Platform please feel free to contact us at info@exantedata.com.

Overall, we are focused on broadening our Global Flow Analytics platform with new models and tools to analyze global capital flows. The CTA model version 2.0 is one example, but we have more exciting announcements on real-money positioning and trade balance nowcasts in the pipeline too.

Jens Nordvig, Founder & CEO

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve macro strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

Follow on twitter: @ExanteData

Connect on LinkedIn: